Central bank denies Economist's allegation of an undervalued Taiwan dollar

Taipei, Nov. 15 (CNA) The central bank on Friday rejected an allegation by The Economist that it has kept the Taiwan dollar undervalued to bolster exports and created "hidden risks" for the economy, saying the currency's value is determined by market supply and demand.

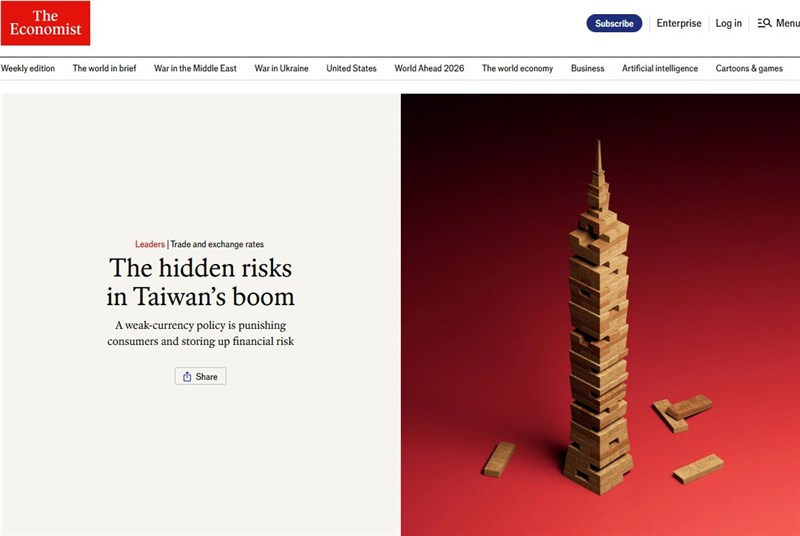

In a statement, the central bank said on Friday that an article in The Economist -- "The hidden risks in Taiwan's boom" -- mistakenly used the Big Mac Index to assess the Taiwan dollar and that the conclusion was distorted.

According to the Economist, the Taiwan dollar is undervalued by 55 percent against the U.S. dollar based on the Big Mac Index, which the magazine used as a measure to show how far a currency has departed from its underlying value.

The magazine said while an undervalued Taiwan dollar boosted Taiwanese exporters' global competitiveness, ordinary Taiwanese consumers have been deprived of the fruits of growth, with financial risks building up.

The weakness of the Taiwan dollar is hurting many Taiwanese people's purchasing power and inflating local home prices, according to The Economist.

● Taiwan central bank, U.S. Treasury agree to avoid exchange rate manipulation

The central bank said the Big Mac Index was flawed and the fact was recognized by The Economist as early as 2003. In addition, The Economist had said in 2006 that the Big Mac Index has been misused to assess a currency's value, according to the central bank.

Therefore, it argued, the Big Mac Index was an inappropriate measurement to gauge whether a currency is overvalued or undervalued.

Citing the iPhone Index, developed by Nomura Securities in 2016 to assess a currency's value based on iPhone prices in the currency's market, the central bank said the Taiwan dollar was 17.1 percent overvalued against the U.S. dollar, quite a different conclusion compared with that of the Big Mac Index.

The central bank emphasized a currency's value will be influenced by many factors and the Taiwan dollar's value has been decided by a supply-and-demand market mechanism, saying in a free financial market, cross-border capital flows have become one of the most important factors to decide a currency's value.

In addition, the central bank said, supply and demand in the currency market is correlated to transactions of financial products.

In 2024, the combined value in fund flows of foreign and local capital was 19.3 times over the value of commodity transactions, the central bank said, so it is not appropriate to use the Purchasing Power Parity to gauge consumer spending power because it is calculated by using only a basket of commodities and services, to value a currency, the central bank said.

Despite a widening trade surplus with the United States so far this year, the central bank said it has consulted with the U.S. Treasury on the foreign exchange rate and macroeconomics matters and the U.S. side has never requested the central bank to boost the Taiwan dollar against the U.S. dollar.

The central bank has conducted market intervention from time to time to smooth volatility in the market. It has said it will continue to communicate with the U.S. Treasury to keep its market intervention transparent.

-

Politics

Two Taiwanese stranded in Israel amid conflict reach Jordan

03/02/2026 09:02 PM -

Business

124,000 Taiwanese have at least NT$100 million in assets: Report

03/02/2026 08:53 PM -

Society

Rain, cooler weather expected across Taiwan on Lantern Festival

03/02/2026 08:13 PM -

Society

Iran conflict to 'severely' delay Taiwan mail to 17 countries

03/02/2026 06:32 PM -

Cross-Strait

Iran could cloud Trump-Xi talks but unlikely to spark Taiwan war: Scholars

03/02/2026 06:13 PM