Taipei, Sept. 12 (CNA) Shares in Taiwan closed at a new high Friday for the fifth consecutive trading session, with buying fueled by lingering optimism over a U.S. Federal Reserve rate cut, dealers said.

The Taiex, the weighted index on the Taiwan Stock Exchange (TWSE), rose 258.93 points, or 1.03 percent, to 25,474.64 after moving between 25,349.70 and 25,492.28. Turnover totaled NT$481.80 billion (US$15.94 billion).

"The local main board's momentum continued today as investors saw major U.S. market indexes hit all-time highs overnight after the latest inflation data, which is unlikely to derail the Fed's rate cuts," Mega International Investment Services analyst Alex Huang said.

"So investors here rushed to pick up tech giants, and their buying accelerated in the late session, boosting contract chipmaker TSMC (Taiwan Semiconductor Manufacturing Co.) to close at a new high as lower interest rates make tech stocks look attractive in terms of dividend yields," Huang said.

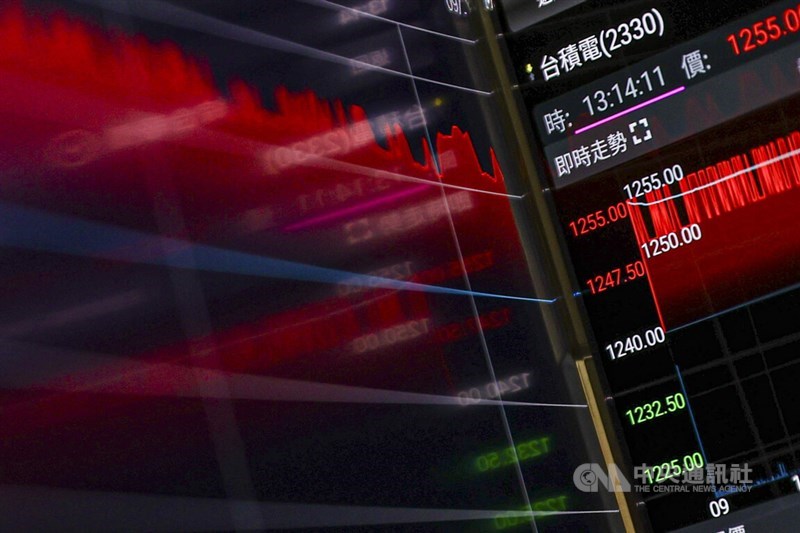

TSMC, the most heavily weighted stock on the market, rose 1.61 percent to close at NT$1,260.00, contributing about 160 points to the Taiex's rise and sending the electronics index up 1.12 percent.

Among other semiconductor stocks, memory chip supplier Nanya Technology Corp. gained 1.59 percent to close at NT$57.40, while smartphone IC designer MediaTek Inc. added 0.34 percent to NT$1,485.00.

"The buying also reflected investors' enthusiasm for artificial intelligence development, so AI-related stocks continued to steam ahead," Huang said, citing iPhone assembler and AI server maker Hon Hai Precision Industry Co., second to TSMC in market value, which gained 1.40 percent to close at NT$217.50.

In addition, Yageo Corp., the world's third-largest maker of multilayer ceramic capacitors (MLCC), soared 10 percent, the maximum daily increase, to close at NT$151.00 after announcing a tender offer to acquire a 28.5 percent stake in power management IC designer Anpec Electronics Corp., which also surged 10 percent to NT$210.50 on the over-the-counter market.

Huang said the financial sector provided additional support to the broader market on rate-cut hopes, rising 1.05 percent.

Fubon Financial Holding Co. rose 1.84 percent to NT$88.50, Cathay Financial Holding Co. gained 1.71 percent to NT$65.50, and CTBC Financial Holding Co. added 1.30 percent to NT$42.80, while E. Sun Financial Holding Co. dipped 0.15 percent to NT$33.85.

While old-economy industries traded mixed, select machinery stocks got a boost from robotics development tied to AI. Among them, Hiwin Technology Co. climbed 3.08 percent to NT$217.50, and its subsidiary Hiwin Microsystem Corp. gained 0.83 percent to NT$122.00.

"The rate-cut leads are expected to push the Taiex higher ahead of the Fed's meeting [scheduled to wrap up Thursday morning]," Huang said. "But I think momentum could moderate as the main board faces technical resistance at around 25,650 points. Be careful about profit-taking."

According to the TWSE, foreign institutional investors bought a net NT$26.53 billion worth of shares on the main board Friday.

- Society

Universal NT$10,000 cash handout to be available as early as Nov. 12

10/23/2025 10:25 PM - Society

High Court rules ex-president Chen Shui-bian cannot be prosecuted

10/23/2025 10:19 PM - Business

AI demand lifts Taiwan's industrial production in September, outlook upbeat

10/23/2025 09:48 PM - Cross-Strait

MAC warns against cooperating with TAO Facebook 'bounty' posts

10/23/2025 09:30 PM - Cross-Strait

Retired Taiwanese general sentenced to 7.5 years for China plot

10/23/2025 09:23 PM