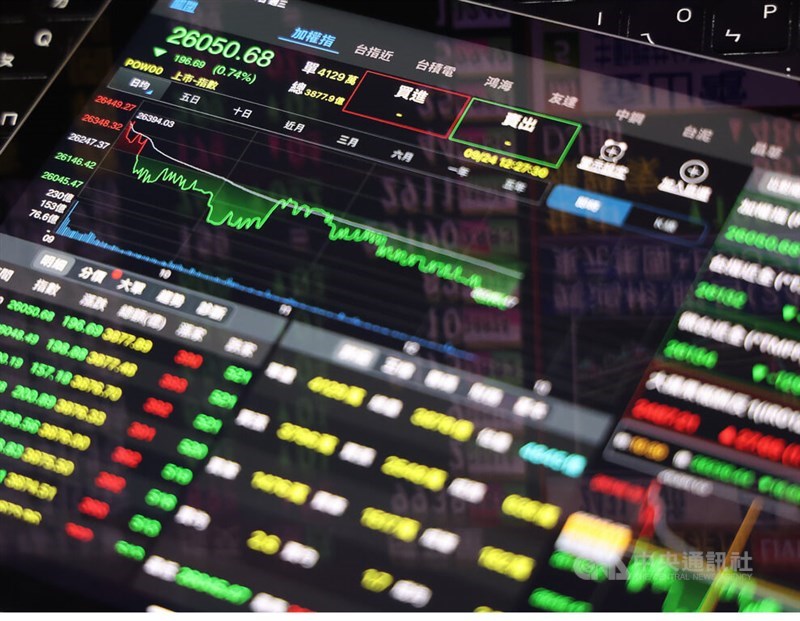

Taipei, Sept. 26 (CNA) Shares in Taiwan moved sharply lower Friday, led by large cap stocks, as investors rushed to pocket recent gains amid growing concerns that the local stock market is overvalued, dealers said.

The Taiex, the Taiwan Stock Exchange's weighted index, ended down 443.53 points, or 1.70 percent, at 25,580.32 after moving between 25,469.04 and 25,998.28. Turnover totaled NT$479.75 billion (US$15.7 billion).

Before Friday, the benchmark Taiex had soared 1,790.75 points, or 6.88 percent, in September to date.

"The local stock market has charged ahead without any major pullback, which has raised concerns over the market overshooting," Concord Securities analyst Kerry Huang said.

"Continued losses in U.S. markets simply gave investors here an excuse to sell."

Ongoing efforts by the Trump administration to put tariffs on imports to the United States also cast a shadow over future prospects.

Overnight, the Trump administration announced a 100 percent tariff on pharmaceutical products under Section 232 of the U.S. Trade Expansion Act.

"Semiconductors are also under a similar investigation," Huang said. "So large cap tech stocks fell victim to fears of a potential huge tariff."

Contract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC), the most heavily weighted stock in Taiwan, fell 1.52 percent to close at NT$1,300.00, sending the electronics index lower by 2,00 percent.

Selling spread to other semiconductor stocks, with smartphone IC designer MediaTek Inc. falling 2.60 percent to end at NT$1,310.00 and memory chip supplier Nanya Technology Corp. shedding 7.31 percent to close at NT$71.00.

Bucking the downturn, United Microelectronics Corp., a smaller contract chipmaker, ended up 1.24 percent at NT$44.85.

Also in the tech sector, iPhone assembler and AI server maker Hon Hai Precision Industry Co. lost 4.57 percent to close at NT$219.50, and power management solution provider Delta Electronics Inc. dropped 4.07 percent to end at NT$848.00.

After recent strong gains on rotational buying, smaller cap printed circuit board makers also suffered heavy profit-taking, dealers said.

Among them, Gold Circuit Electronics Ltd. shed 5.12 percent to close at NT$412.50, and Zhen Ding Technology Holding Limited shed 4.35 percent to end at NT$165.00.

Selling was seen almost across the board with non-tech stocks under heavy pressure throughout the session, Huang said.

Falling from previous gains on a spike in copper prices, Hua Eng Wire and Cable Co. lost 3.83 percent to close at NT$3.40, and rival Walsin Lihwa Corp. fell 4.29 percent to close at NT$25.05.

Elsewhere in the old economy sector, King's Town Construction Co. dropped 2.45 percent to close at NT$45.80, and Farglory Land Development Co. ended down 2.05 percent at NT$62.20.

In the financial sector, which appeared resilient, falling only 0.18 percent, Fubon Financial Holding Co. rose 0.58 percent to close at NT$86.50, and Cathay Financial Holding Co. lost 0.91 percent to end at NT$65.10.

"The Taiex fell below a critical technical support level at around 25,770 points, the 10-day moving average, and I expect more losses in the short term," Huang said.

According to the Taiwan Stock Exchange, foreign institutional investors sold a net NT$25.19 billion in shares on the market Friday.

-

Sports

Taiwan shuttlers in four semi-finals at badminton German Open

02/28/2026 02:48 PM -

Society

Yushan sees snowfall as wetter weather hits Taiwan: CWA

02/28/2026 01:00 PM -

Society

Taiwan headline news

02/28/2026 11:02 AM -

Politics

Archives show 228 violence extended beyond Taipei: Researcher

02/28/2026 10:50 AM -

Politics

To some, transitional justice has yet to expunge ghosts of 228 Incident

02/28/2026 09:49 AM