Taipei, Sept. 24 (CNA) Shares in Taiwan closed slightly lower Wednesday after hitting a fresh high a session earlier, as investors took cues from a pullback on U.S. markets overnight amid concerns about overvalued equity prices, dealers said.

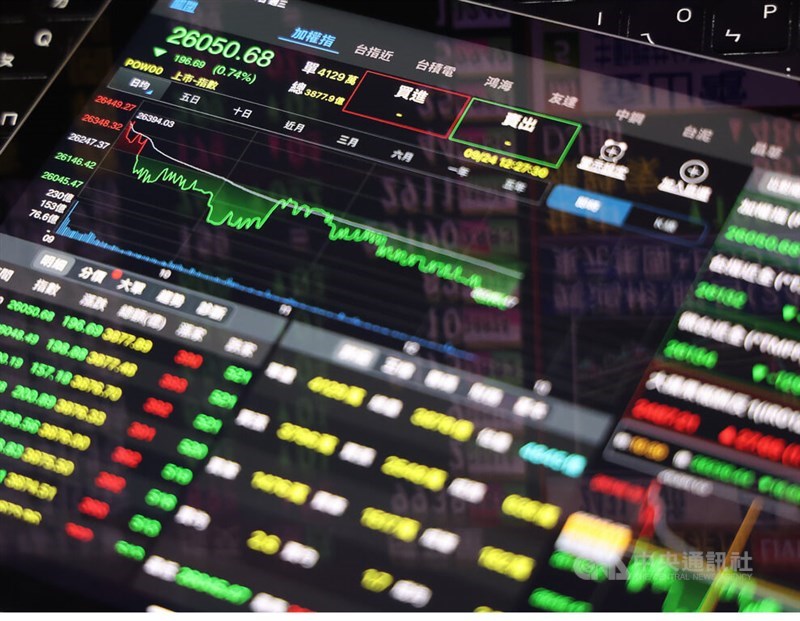

The Taiex, the weighted index on the Taiwan Stock Exchange (TWSE), ended down 50.64 points, or 0.19 percent, at 26,196.73 after moving between 26,045.47 and 26,394.03. Turnover totaled NT$497.71 billion (US$16.40 billion).

Before Wednesday, the local main board had soared 2,014.27 points, or 8.31 percent, so far this month, vaulting the Taiex to a new high of 26,247.37 on Tuesday.

"After recent solid gains, it was no surprise that the Taiex entered consolidation mode today, particularly after the losses on U.S. markets," Mega International Investment Services analyst Alex Huang said.

The major U.S. indexes gave up earlier gains Tuesday after Federal Reserve Chair Jerome Powell warned: "Equity prices are fairly highly valued."

"Fortunately, large-cap tech stocks largely appeared resilient, as TSMC (Taiwan Semiconductor Manufacturing Co.) recouped its earlier losses to prevent the broader market from falling further amid lingering optimism toward artificial intelligence development," Huang said.

"Such hopes have been boosted by recent prominent plans, including Nvidia's pledged US$100 billion investment in OpenAI."

TSMC, the most heavily weighted stock, closed unchanged at NT$1,340.00, off a low of NT$1,325.00. Buying rotated to United Microelectronics Corp., a smaller contract chipmaker, which rose 2.16 percent to end at NT$44.85.

Scientech Corp., TSMC's IC assembly equipment provider, soared 10 percent-the maximum increase-to close at NT$426.50, but memory chip supplier Nanya Technology Corp. lost 3.27 percent to end at NT$133.00.

Also in the tech sector, iPhone assembler and AI server maker Hon Hai Precision Industry Co. rose 0.90 percent to close at NT$223.00, and Compal Electronics Inc. surged 10 percent to end at NT$34.50 on reports that the company has secured NT$100 billion worth of AI server orders from Dell.

Printed circuit board makers faced heavier pressure, with WUS Printed Circuit Co. down 2.42 percent to close at NT$101.00 and Unimicron Technology Corp. down 1.26 percent to end at NT$157.00.

Outside the electronics sector, select "military concept stocks" faced profit-taking after their recent strong showing, Huang said. Fighter jet developer Aerospace Industrial Development Corp. lost 3.51 percent to close at NT$60.40, and Lungteh Shipbuilding Co. was down 1.98 percent to end at NT$148.50.

Amid weakness in the old-economy sector, Formosa Plastics Corp. lost 1.42 percent to close at NT$38.05, and Nan Ya Plastics Corp. shed 3.02 percent to end at NT$38.60.

In the mixed financial sector, Cathay Financial Holding Co. dropped 0.30 percent to close at NT$66.00, while Fubon Financial Holding Co. ended up 0.68 percent at NT$89.00.

According to the TWSE, foreign institutional investors sold a net NT$12.95 billion worth of shares on the main board on Wednesday.

-

Sports

Taiwan shuttlers in four semi-finals at badminton German Open

02/28/2026 02:48 PM -

Society

Yushan sees snowfall as wetter weather hits Taiwan: CWA

02/28/2026 01:00 PM -

Society

Taiwan headline news

02/28/2026 11:02 AM -

Politics

Archives show 228 violence extended beyond Taipei: Researcher

02/28/2026 10:50 AM -

Politics

To some, transitional justice has yet to expunge ghosts of 228 Incident

02/28/2026 09:49 AM